NTN Registration Process – Quick Summary

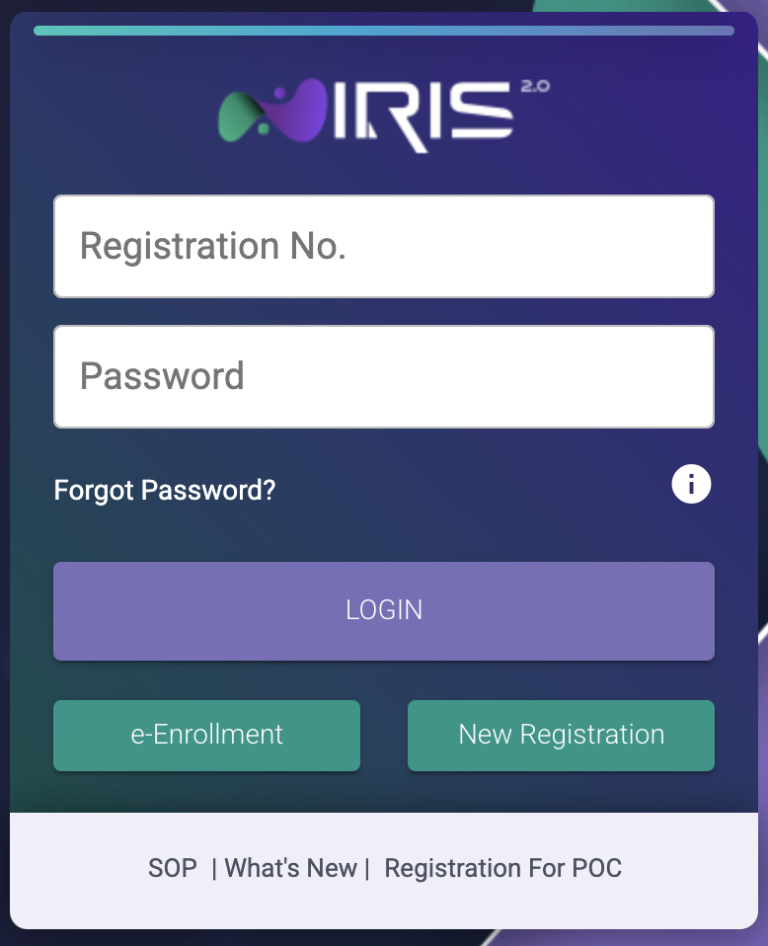

Go to the FBR Website – Visit https://iris.fbr.gov.pk/login

Click on “New Registration” – Start the NTN registration process.

Fill Out the Registration Form – Provide your CNIC, full name, email, mobile number, and complete address.

Submit the Form – Double-check all details and submit the application.

Complete the OTP Verification – Enter the OTP sent to your registered mobile and email.

Receive Login Credentials – After successful verification, you’ll get your username and password for FBR login.

What is NTN and what it is used for?

NTN stands National Tax Number, If you’re looking to start a business or file your income tax in Pakistan, obtaining a (NTN) is the first essential step.

The NTN registration is a very simple process and it is is required for income tax filing, sales tax registration and filing, business registration, and company registration.

At Taxfiler.online, we provide expert tax consultancy services to help you register your NTN quickly and efficiently. In this step-by-step guide, we’ll walk you through the complete NTN registration process, making it easy to get their NTN register without any hassle.

Steps for NTN Registration

- Go to FBR Official website by following this link; https://iris.fbr.gov.pk/login

- Click on New Registration that is located under the login Block

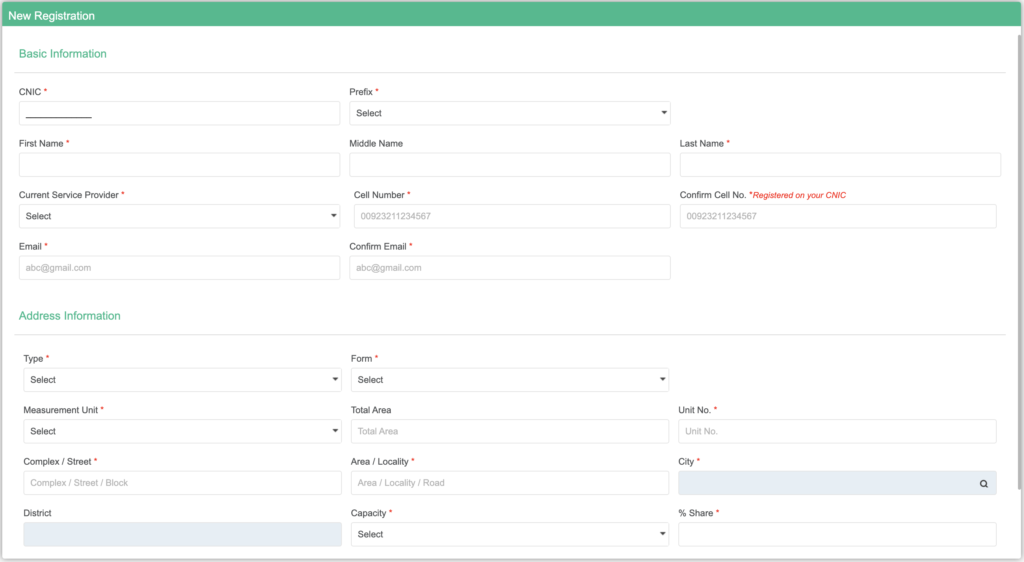

Fill the Registration Form

1. Enter Your CNIC Number

Your CNIC (Computerized National Identity Card) number is one of the most crucial details required for NTN registration. This number uniquely identifies you in the FBR (Federal Board of Revenue) database. Make sure to enter your CNIC correctly to avoid any issues during verification.

2. Provide Your Full Name

Your CNIC (Computerized National Identity Card) number is one of the most crucial details required for NTN registration. This number uniquely identifies you in the FBR (Federal Board of Revenue) database. Make sure to enter your CNIC correctly to avoid any issues during verification.

3. Add Your Email Address

A valid email address is required for communication with FBR. This is where you’ll receive important updates, notifications, and any follow-up information related to your NTN application. Make sure to use an active email that you check regularly as you will get OTP and password during NTN registration process.

4. Enter Your Mobile Number

Your mobile number is required for verification purposes. FBR will send an OTP (one-time password) to confirm your identity, so ensure that the number you provide is in use and correctly entered.

5. Fill in Your Complete Address

Your address should be accurate and complete. This includes your house number, street name, city, and postal code. The address you provide will be used for official correspondence from the tax authorities.

OTP Verification Process

1. Submit the Form

Once you have filled in all the required details, double-check your information for accuracy. Any errors or mismatched information can delay the registration process. After verifying your details, submit the form.

2. Enter the OTP

Once the form is submitted, you will be redirected to the next screen, where the system will ask you to enter the OTP (one-time password) sent to your registered mobile number and email address. Enter the OTP correctly to proceed.

3. Completion of Registration

After entering the OTP, your NTN registration process will be completed. You will receive your username and password via email and SMS. These credentials will allow you to log in to your FBR account for tax-related services.

Did you forget your NTN Password Click here to know How to Recover NTN Password